2020 SMB Shipping Strategy Report

Increased Shipping Spend and Big Box Influence Highlight the Findings of SMB Decision Makers Logistics Study

When it comes to shipping and logistics today, small and mid-size businesses (SMB) decision makers find themselves in an awkward position. Try offering next-day, free delivery like big-box retailers and risk losing your shirt. Or stick with multiple-day, non-free delivery and risk losing your market share to customers conditioned by the Amazon Effect.

Throughout 2019, this underlying tension — and influence from big-box retailers — has been building. In 2020, it’ll come to a head as SMBs are rethinking how they invest their shipping and logistics dollars, where to invest in technology over team (or vice versa), and where they can turn for trusted, reliable, affordable delivery options.

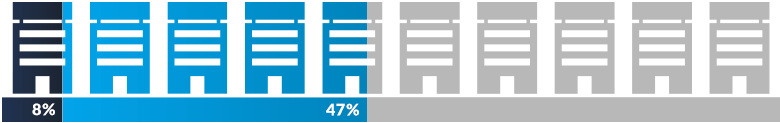

2020 SMB Shipping Spend Outlook

- 47% of SMB decision makers plan to increase their shipping spend in 2020 compared to 2019.

- 8% of SMB decision makers plan to increase their shipping spend by at least 26% in 2020 compared to 2019.

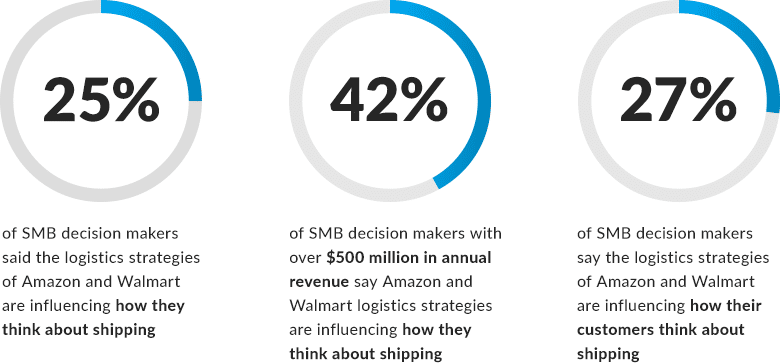

Big Box Influence

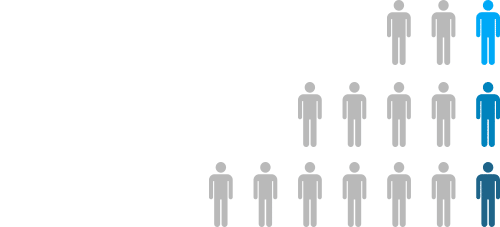

Tech vs. Team

-

- 1 in 3 (30%) of SMB decision makers plan to make new technology a priority

-

- 1 in 5 (20%) of SMB decision makers would rather invest in the right logistics team over technology

- 1 in 7 (17%) of SMB decision makers say investing in new technology is too expensive

New Approaches

1 in 6 (17%) prefer to invest in alternatives to traditional shipping options such as UPS, FedEx, XPO Logistics, and freight brokers.

1 in 10 (11%) don’t know where to find alternative shipping options to organizations like UPS, XPO Logistics, and freight brokers.

Large and Bulky Struggle

Shipping large and bulky e-commerce — furniture, vehicles, sporting equipment, safes, and more — remains a mystery to some. Among SMB decision makers, the survey finds:

About the Survey:

All figures, unless otherwise stated, are from YouGov Plc. Total sample size was 502 adults. Fieldwork was undertaken between Nov. 22 – Dec. 4, 2019. The survey was carried out online. The figures have been weighted and are representative of all US Small Business Decision Makers.