While we’re no tax experts, we’ve put together these tax tips as a helpful resource based on frequently asked questions we get around tax season.

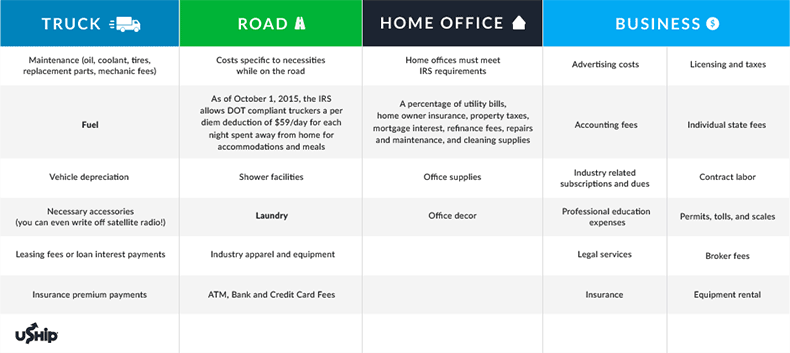

Click here for a high res version of the above chart.

What tax forms does uShip provide?

Short answer: None. Long answer: Service providers who utilize our online marketplace to source loads are neither contractors of uShip or uShip employees, and therefore we cannot provide tax forms.

How can I calculate income from uShip bookings?

Go to Transaction History while logged in. You can then select the date ranges you need. There are the options to print it or export to a spreadsheet by clicking “Download to Excel”

What deductions can I claim?

First, before you begin your deductions, separate business and personal accounts for easier deduction calculations. For more specific details about deductions we’ve used tax preparation software TaxSlayer.com as a source for this and put together a table.

Any tax tips when claiming deductions?

Yes. For owner-operators there are some deductions that shouldn’t be claimed to help avoid being audited. Make sure not to deduct any of the following:

- Time incurred working on your own equipment

- Income lost for dry runs and unpaid mileage

- Downtime

- Everyday clothing

- Commuting costs

- Utilities not used for business purposes

- Personal loan interest

- Personal vacations

- Student loan interest or principal